new mexico pension taxes

Taxable as income but low-income taxpayers 65 and older may exempt up to 8000 of income from New Mexico taxes. Does New Mexico offer a tax break to retirees.

New Mexico Lawmakers Ok Crime Bill 500m In Tax Rebates New Mexico News Us News

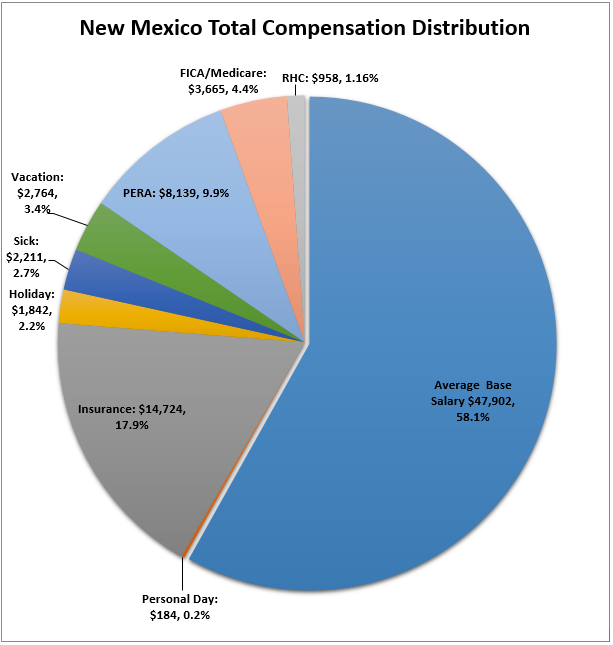

The employer pays 315 of employees base salary as pension contributions for unemployment and old age insurance.

. Does New Mexico offer a tax break to retirees. Depending on income level taxpayers 65 years of age or older may be eligible for a deduction from taxable income of up to 8000 each. These payments generally are available to individuals between ages 55 and 71 and must begin at least one year prior to reaching age 72.

Any veteran who rated 100 service-connected disabled by the VA can get a. SANTA FE HB 76 passed the House Labor Veterans and Military Affairs Committee with unanimous bipartisan support. Santa Fe Main Office 8am-5pm.

Managing the retirement assets of New Mexico Educators since 1957. Depending on income level taxpayers 65 years of age or older may be eligible for a deduction from taxable income of up to 8000 each. Reported by committee to fall within the purview of a 30 day session.

Removes the 90 percent salary cap on pensionable compensation The changed COLA is expected to vary between 05 and 3 each year and average out to 164 annually compared to the current fixed. Could increased liquidity give you more control over your 500K in retirement savings. You are not 65 but are considered blind for federal tax purposes.

If HB 49 gets passed then it would extend to all retirees with. High earners individuals who have income above 210000 and couples that file jointly with income above 315000 will be subject to a. Is my retirement income taxable to New Mexico.

Overview of New Mexico Taxes. The New Mexico tax filing and tax payment deadline is April 18 2022Find IRS or Federal Tax Return deadline details. On January 19 2022 in the Senate.

Low-income taxpayers may also qualify for a property tax rebate even if they rent their primary residence. Ad e-File Free Directly to the IRS. The state does not collect a sales tax but rather a gross receipts tax on businesses that often gets passed to consumers.

Low-income taxpayers may also qualify for a property tax rebate even if they rent their primary residence. Starting in 2022 all military retirees may exclude 50 percent of their military retirement benefits New Mexico. The bill would support retired veterans by making up to 30000 of their military retirement pay exempt from state income tax.

The bill includes a cap for exemption eligibility of 100000 for single filers and 150000 for married couples filing jointly. New Mexico has a progressive income tax with rates that rank among the 20 lowest in the country. The lower tax rate is 4 on taxable income from 5001 to 10000 and the higher rate is 5 on taxable income of more than 10000.

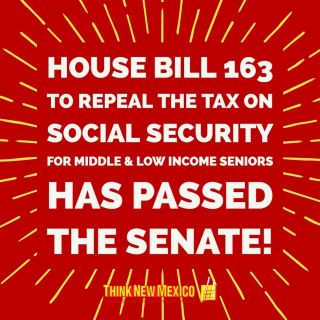

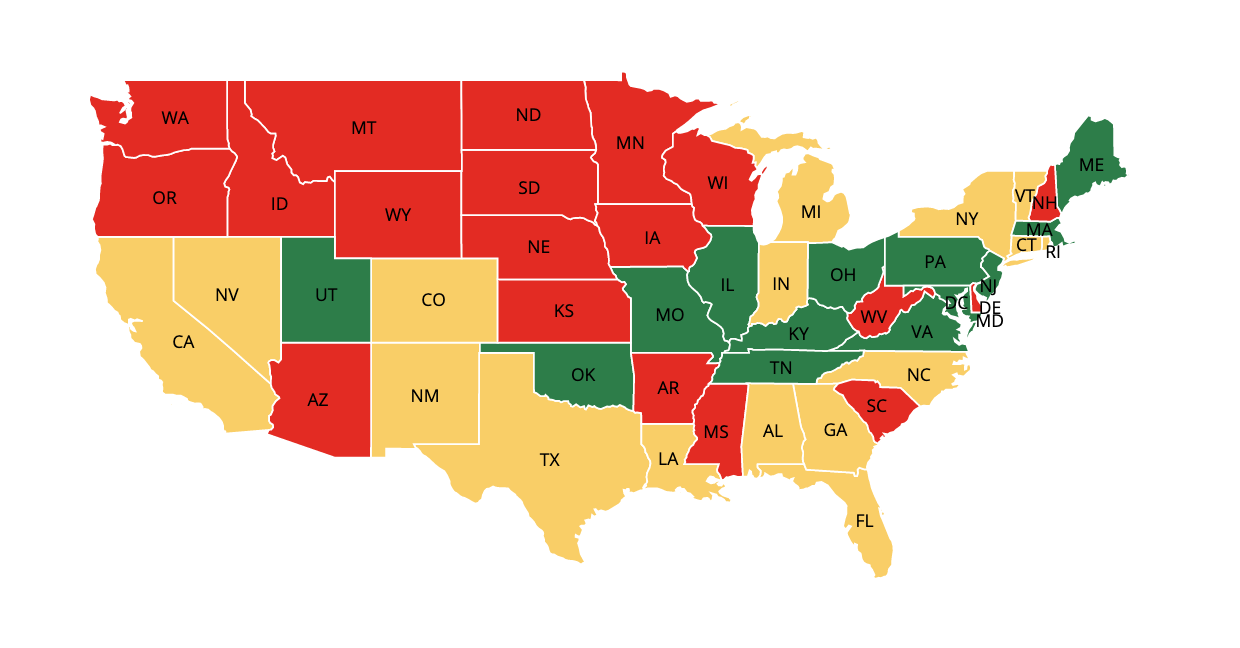

The new tax changes restrict state taxes on Social Security income to retirees who make more than 100000 a year or joint tax. In New Mexico low income retirees are not taxed on their social security income. On January 20 2022 in the Senate.

Whats New Seminars Presentations. 52 rows 40000 single 60000 joint pension exclusion depending on. Retired Members tax documents 1099-R have been mailed out.

New Mexico Veteran Financial Benefits Income Tax. By exempting veterans retirement pay from state income tax they can keep more of what they earned for their selfless. The exemption gradually phases out as income rises and it disappears for single filers whose federal adjusted gross.

New Mexico on Tuesday joined a growing number of states that have reduced or eliminated taxes on Social Security benefits. It allows individuals aged 65 and over with a GDI of 51000 or less for married couples and 28500 or less for singles to deduct up to 8000 in income that can be applied to benefits. In order to more easily transition into retirement you may be able to withdraw up to 10 in.

However for 2021 taxes a new bracket is being introduced. Income Tax Range. Michelle Lujan Grisham a Democrat signed House Bill 163 exempting.

E-FIle Directly to New Mexico for only 1499. Retired Members 1099R Tax Document. New Mexico is among a dozen states that tax Social Security benefits.

But legislators in the state have introduced competing bills to end the tax on Social Security benefits. Ad Download Fisher Investments free guide Is a Lump Sum Pension Withdrawal Right for you. New Mexico allows you to exclude your retirement income of up to 8000 based off of your filing status and your federal adjusted gross income if you meet one of the following.

You are 65 or older. The bill eliminates taxation on social security saving New Mexico seniors over 84 million next year. For 2022 Mississippi has two tax rates.

Active duty military pay is tax-free. Free 2020 Federal Tax Return. Otherwise New Mexico treats Social Security benefits for tax purposes in the same way as other income.

The states average effective property tax rate is also on the lower side. E-File Directly to the IRS State. Disabled Veteran Tax Exemption.

Sent to SCC - Referrals.

How Taxes Can Affect Your Social Security Benefits Vanguard

Retirement Security Think New Mexico

Retirement Security Think New Mexico

What Happens To Taxpayer Funded Pensions When Public Officials Are Convicted Of Crimes Reason Foundation

Retirement Eligibility Nm Educational Retirement Board

Tax Withholding For Pensions And Social Security Sensible Money

Retirement Security Think New Mexico

New Mexico Retirement Tax Friendliness Smartasset

New Mexico Income Tax Calculator Smartasset

New Mexico Retirement Tax Friendliness Smartasset

Tax Withholding For Pensions And Social Security Sensible Money

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Retirement Security Think New Mexico

Where S My State Refund Track Your Refund In Every State Taxact Blog

Solved Lance H And Wanda B Dean Are Married And Live At Chegg Com